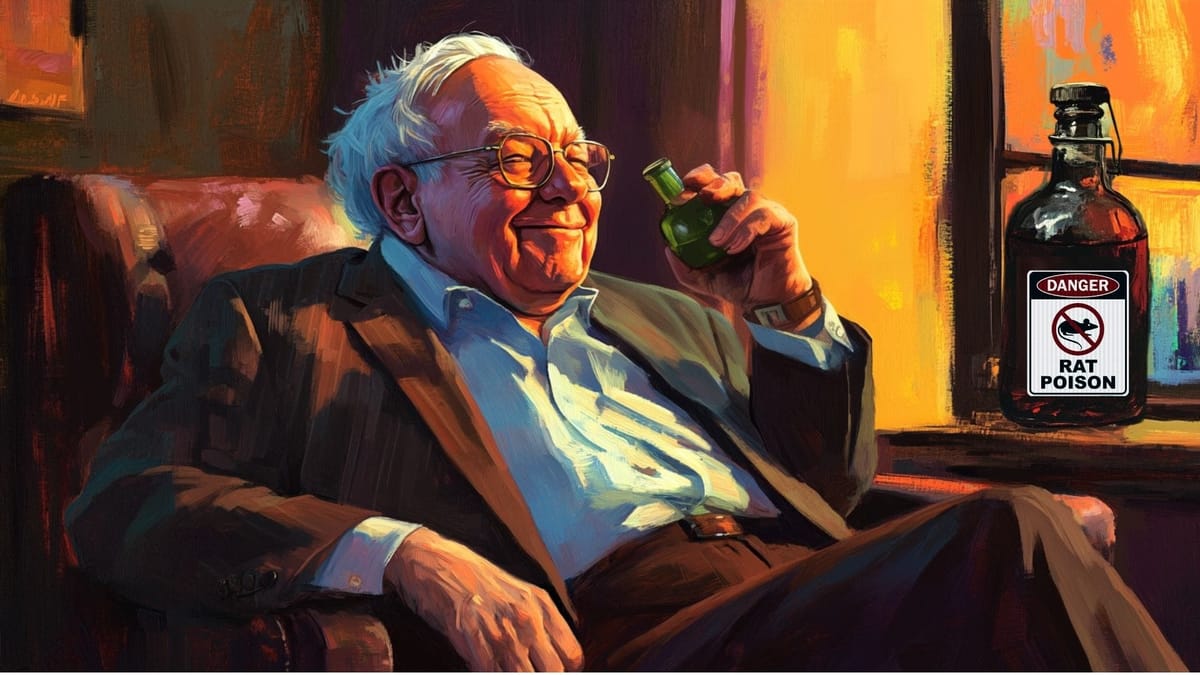

Berkshire Hathaway's Warren Buffet admits: "I was wrong. Rat poison squared is actually quite tasty."

In a shocking turn of events that has the finance world questioning reality itself, Warren Buffett, the Oracle of Omaha and long-time crypto skeptic, has publicly declared his newfound love for the very "rat poison squared" he once despised: Bitcoin.

At a hastily arranged press conference, a glassy-eyed Buffett, sporting a Bitcoin logo tie and a "Have Fun Staying Poor" hat, announced Berkshire Hathaway's plan to liquidate all its holdings and go all-in on cryptocurrency.

"I've seen the light, and it's shaped like a big orange B," Buffett declared, his hands shaking as he clutched a hardware wallet. "Turns out, rat poison squared is quite the delicacy when you acquire a taste for it. Who knew?"

The 91-year-old billionaire admitted his change of heart came after a weekend bender with Michael Saylor and the Winklevoss twins. "Those boys know how to party," Buffett chuckled, attempting to dab. "One minute we're doing Jell-O shots, the next I'm mortgaging my house to buy more Dogecoin. It's all a bit hazy."

Wall Street analysts are scrambling to make sense of Buffett's 180-degree turn. "We always said to inverse Buffett, but we didn't think he'd inverse himself," said one bewildered fund manager, last seen panic-buying Bitcoin on his phone.

Berkshire Hathaway's new crypto-focused strategy includes:

- Rebranding See's Candies as "Satoshi's Sweeties"

- Converting all Dairy Queen locations into Bitcoin mining operations

- Replacing Geico's gecko mascot with a laser-eyed honey badger

When asked about his previous statements comparing Bitcoin to "rat poison squared," Buffett shrugged. "Ever tried rat poison? Don't knock it 'til you've tried it. This stuff makes tulips look like a boomer investment."

The impact on the crypto market was immediate and explosive. Bitcoin surged 42,069%, causing multiple exchanges to crash and at least one satellite to fall out of orbit. The GDP of several small nations is now less than the average Crypto Twitter influencer's portfolio.

Meanwhile, traditional finance is in chaos. The New York Stock Exchange has announced plans to replace the opening bell with the sound of a dial-up modem connecting to the internet. Goldman Sachs is reportedly considering a pivot to become a "meme merchant bank."

As of press time, Buffett was last seen trying to convince his longtime partner Charlie Munger to join TikTok. "Come on, Charlie," Buffett pleaded, "the kids will love your rug pull tutorials!"

The Meme Street Journal reminds readers that while past performance is not indicative of future results, a billionaire's midlife crisis at 91 is guaranteed entertainment. Remember: DYOR (Don't Yeet Our Retirement).

About the Author: Kobayashi Mememoto is an independent journalist with years of experience at the intersection of memes, crypto, and finance. Kobayashi's articles have been featured in several finance and crypto publications, with his main expertise being in memecoin trading. Mememoto's motto? "If you're not willing to lose it all on the next pump.fun jeet token, are you even investing?"