How L1 Blockchains Benefit from Meme Coin Communities: The Solana Case Study

Part 1: The Symbiotic Relationship

The relationship between Layer-1 blockchains and meme coin communities represents one of the most fascinating and least understood dynamics in cryptocurrency. Nowhere is this relationship more evident than in the case of Solana, where the emergence of successful meme coins has fundamentally transformed the ecosystem's trajectory.

The Catalyst Effect

Andre, a veteran crypto investor since 2017, articulates this relationship succinctly: "Meme coins are very good user acquisition tool for almost any chain, not only for L1s but also for L2s. We can see a lot of examples how meme coins push these chains." This observation became particularly apparent in Solana's ecosystem, where the emergence of key meme coins marked turning points in the network's adoption.

The transformation wasn't merely about numbers – it represented a fundamental shift in how blockchain platforms attract and retain users. As Andre explains, "When they sold this meme coins or when they hold this meme coins it doesn't matter they could try to do something else... I can exchange the parts to the L1 native token of course this is nice onboarding."

The Bonk Revolution

The story of Solana's meme coin renaissance begins with what Mike Dudas describes as a pivotal moment: "We'll use Bonk as an example that was at the bottom of the last bear market Solana not a lot of onchain activity... Bonk launched airdrop to developers to anybody who had basically transacted on chain and said hey let's rally around this coin and let's get folks excited."

This strategic airdrop accomplished several critical objectives:

- Reactivated dormant users

- Created renewed interest in the ecosystem

- Demonstrated Solana's technical capabilities

- Built community momentum during a bear market

The Network Effect Amplifier

What makes meme coins particularly effective as catalyst events for L1 blockchains is their ability to create what we might call a "network effect amplifier." Morad notes that when examining successful meme coins, "You need to figure out this is why it's getting much more competitive... when other stuff came out it was a completely different market."

The amplification occurs through several mechanisms:

First, meme coins create what Mike Dudas calls "permissionless participation" – allowing anybody to engage with the blockchain in a way that feels accessible and fun. This removes the intimidation factor often associated with more technical aspects of cryptocurrency.

Second, these communities generate what Morad describes as "free labor" – passionate community members who become unofficial ambassadors not just for their particular meme coin, but for the underlying blockchain itself. When someone learns to use Solana to trade a meme coin, they're simultaneously learning to navigate the broader Solana ecosystem.

The Technical Advantage

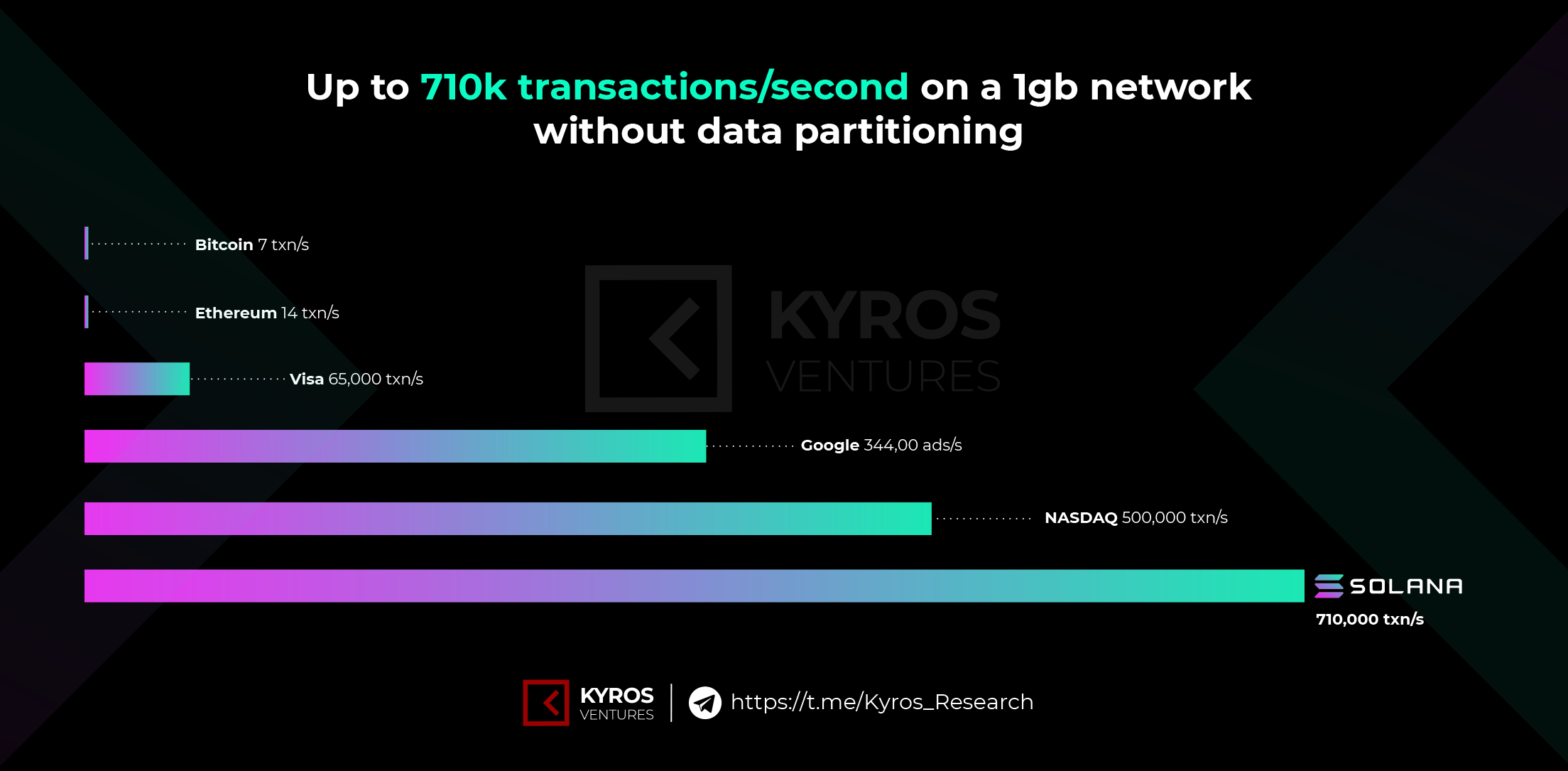

Solana's case is particularly interesting because of what Andre identifies as the technical synergy: "Solana after Bonk 100 of thousand mem coins were launched... even before pump fun then Millions after pump fun." The blockchain's high speed and low transaction costs created an ideal environment for meme coin trading, which in turn drove more users to experience these technical benefits firsthand.

This created what we might call a "technical discovery loop" – users come for the meme coins but stay for the underlying technology. As these users explore other applications within the ecosystem, they become more deeply embedded in the network, creating lasting value beyond the initial meme coin attraction.

The Platform Evolution and Community Dynamics

The Infrastructure Revolution

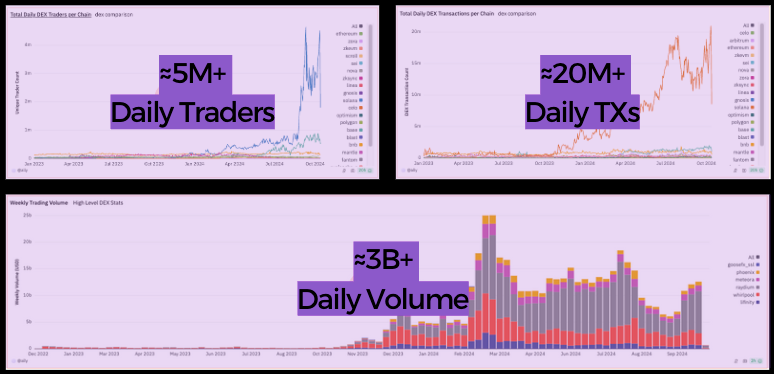

The relationship between Solana and its meme coin communities entered a new phase with the emergence of sophisticated trading platforms. This evolution transformed what was initially a grassroots phenomenon into a structured ecosystem that further accelerated L1 adoption.

The Pump.fun Effect

Mike Dudas provides crucial insight into this transformation: "They've pump reduced the cost, the UI/UX to basically zero now to launch a coin... it gets to the Chris Dixon you know everything important starts out looking like a toy." This democratization of token creation had profound implications for Solana's ecosystem, creating what we might call a "perpetual engagement engine."

The impact was multi-layered. As more users entered the ecosystem through these platforms, they began to experience what Andre describes as immediate feedback: "From investors perspective in meme coins they give you feedback if your investment is successful or not much faster than utility tokens because there is no wasting no development time nothing - you invest it, you see your result."

The Velocity of Innovation

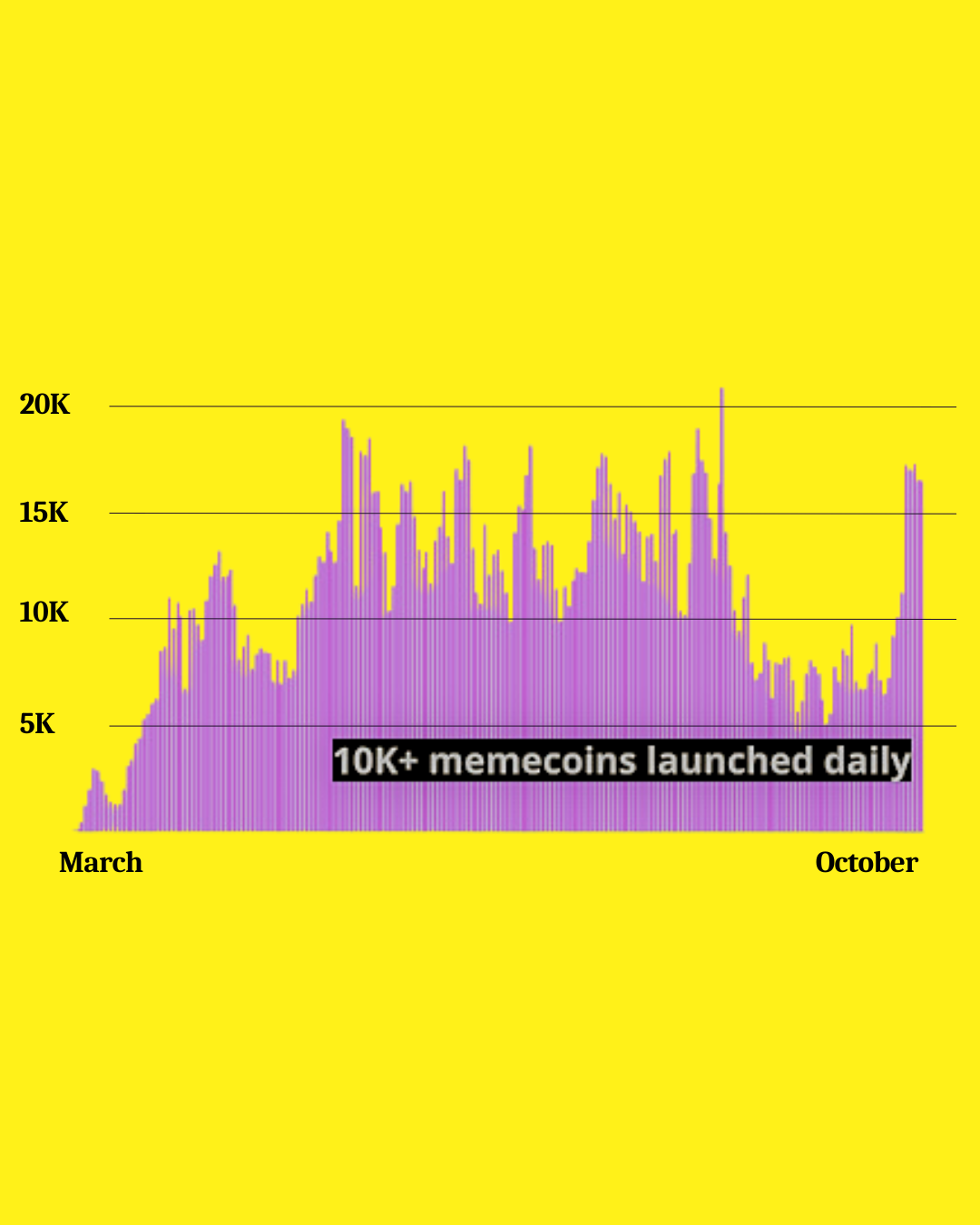

What makes the Solana case study particularly interesting is the speed at which innovation occurred. Morad notes that "when whiff and popcat were first kind of being launched in late 2023 you were you only had like a few hundred million coins being created per day... right now you have like 10,000 coins launching per day."

This exponential growth in activity created what we might call a "velocity advantage" for Solana. The blockchain's technical capabilities – particularly its high throughput and low transaction costs – became increasingly valuable as trading activity intensified. Each successful meme coin launch reinforced Solana's position as the preferred platform for this type of activity.

The Community Multiplier Effect

One of the most fascinating aspects of this evolution is what Anom calls the "distribution" factor. Speaking about successful meme coins, he explains: "If you have more distribution as in like a ton of holders who have a smaller percentage of supply, that's typically better for the memes in early stages because then you also have an army of people who are rallying behind the meme all at the same time."

This distribution dynamic created a unique benefit for Solana. Each successful meme coin community effectively became a subnet of the broader Solana ecosystem, creating what we might call "community layers" that enhanced the network's overall resilience and appeal.

The Learning Curve Acceleration

Perhaps most significantly, meme coins served as what Mike Dudas describes as an "incredible zero to one change" in how people engage with blockchain technology. The simplicity of meme coin trading created an intuitive entry point that helped users overcome the traditional barriers to blockchain adoption.

This accelerated learning curve had particular significance for Solana because, as Morad notes, "retail at this point if they have to join crypto in order to understand the tech protocols they need to learn reking, staking like you know impermanent loss all the layer twos layer 3s bridges and it's getting like more and more complicated."

The Market Making Evolution

The maturation of the meme coin ecosystem brought another crucial benefit to Solana: sophisticated market making and liquidity provision. Andre explains that successful projects require "structure everything from the beginning to the success." This professionalization of trading infrastructure further enhanced Solana's appeal as a platform for serious trading activity.

Future Implications and Strategic Insights

The Shifting Landscape

As we look to the future of L1 blockchains and their relationship with meme coin communities, the Solana case study provides crucial insights into what Morad calls "the next year year and a half is going to be a meme coin cycle." This prediction has profound implications for how L1 blockchains position themselves in the evolving crypto ecosystem.

Beyond Simple Trading

The future relationship between L1s and meme coins appears to be moving toward what Anom predicts will be a more sophisticated integration: "I think that there's going to be a lot of ways that you set up similar mini games to pump fun with coins NFTs, all these different things that people can play." This evolution suggests that successful L1 blockchains will need to support not just trading, but entire ecosystems of engagement.

The Price Correlation Effect

One of the most interesting aspects of the Solana case study is what Morad identifies as a potential "divergence between the chain and the memes." He explains, "Now there's a lot of companies and platforms and apps that allow you to go from Fiat directly into memes, like moonshot think slingshot spot and a couple of others they allow you to just go Apple pay to memes or bank account to memes."

One of these memecoin trading platforms is PUMP100x that allows you to trade memes within minutes in a fun way on your mobile worldwide.

This direct access to meme trading could fundamentally change how L1 blockchains derive value from meme coin activity. While early success was marked by direct correlation between meme coin trading and SOL price appreciation, the future may see more nuanced relationships developing.

The Evolution of Value Creation

Perhaps the most significant insight from the Solana case study is what Mike Dudas identifies as a fundamental shift in how value is created in crypto: "Crypto, one of its massively amazing and wonderful attributes is that virtually everything that has value today has bootstrapped immense amounts of its overall value that's accrued to date via mimetic value."

This understanding suggests that L1 blockchains need to embrace rather than resist the mimetic aspects of their ecosystems. The success of Solana demonstrates that technical superiority alone is insufficient – chains need to foster environments where both technical and mimetic value can flourish.

The Community Integration Challenge

Looking ahead, L1 blockchains face what Morad describes as an evolution in community dynamics: "We are now going to evolve to a more serious level which is tokenizing ideology or tokenizing philosophy, tokenizing extremely abstract political ideals." This suggests that successful L1s will need to support not just trading communities, but ideological and cultural movements.

Strategic Implications for L1 Blockchains

The lessons from Solana's experience suggest several key strategic considerations for other L1 blockchains:

First, the importance of what Anom calls "relatability" cannot be overstated. Successful L1s need to support experiences that new users can easily understand and engage with, even if they don't fully grasp the underlying technology.

Second, the role of what Mike Dudas describes as "permissionless" participation becomes crucial. L1s need to create environments where innovation can happen spontaneously and community-driven projects can flourish without excessive barriers.

The Future Horizon

As we look ahead, the relationship between L1 blockchains and meme coin communities appears poised for further evolution. Morad's prediction of meme coins potentially reaching "a trillion dollar market cap" suggests that this relationship will become increasingly important for L1 success.

The key insight from the Solana case study isn't just that meme coins can drive L1 adoption – it's that successful L1 blockchains need to create environments where multiple forms of value creation can coexist and reinforce each other. As Andre notes, this requires "structure everything from the beginning to success."

Conclusion

The Solana case study represents more than just a successful integration of meme coins and L1 technology – it provides a blueprint for how blockchain platforms can harness the power of community-driven innovation while maintaining technical excellence. As the crypto ecosystem continues to evolve, the lessons learned from this relationship will likely become increasingly valuable for both existing and emerging L1 platforms.

The future success of L1 blockchains may well depend on their ability to replicate and build upon what Mike Dudas calls the "incredible zero to one change" that meme coins represent. Those that can successfully balance technical capability with community engagement while supporting both mimetic and fundamental value creation will be best positioned for long-term success.

About the Author: Kobayashi Mememoto is an independent journalist with years of experience at the intersection of memes, crypto, and finance. Kobayashi's articles have been featured in several finance and crypto publications, with his main expertise being in memecoin trading. Mememoto's motto? "If you're not willing to lose it all on the next pump.fun jeet token, are you even investing?"