Is the Memecoin Supercycle Coming? Market Evidence & Analysis

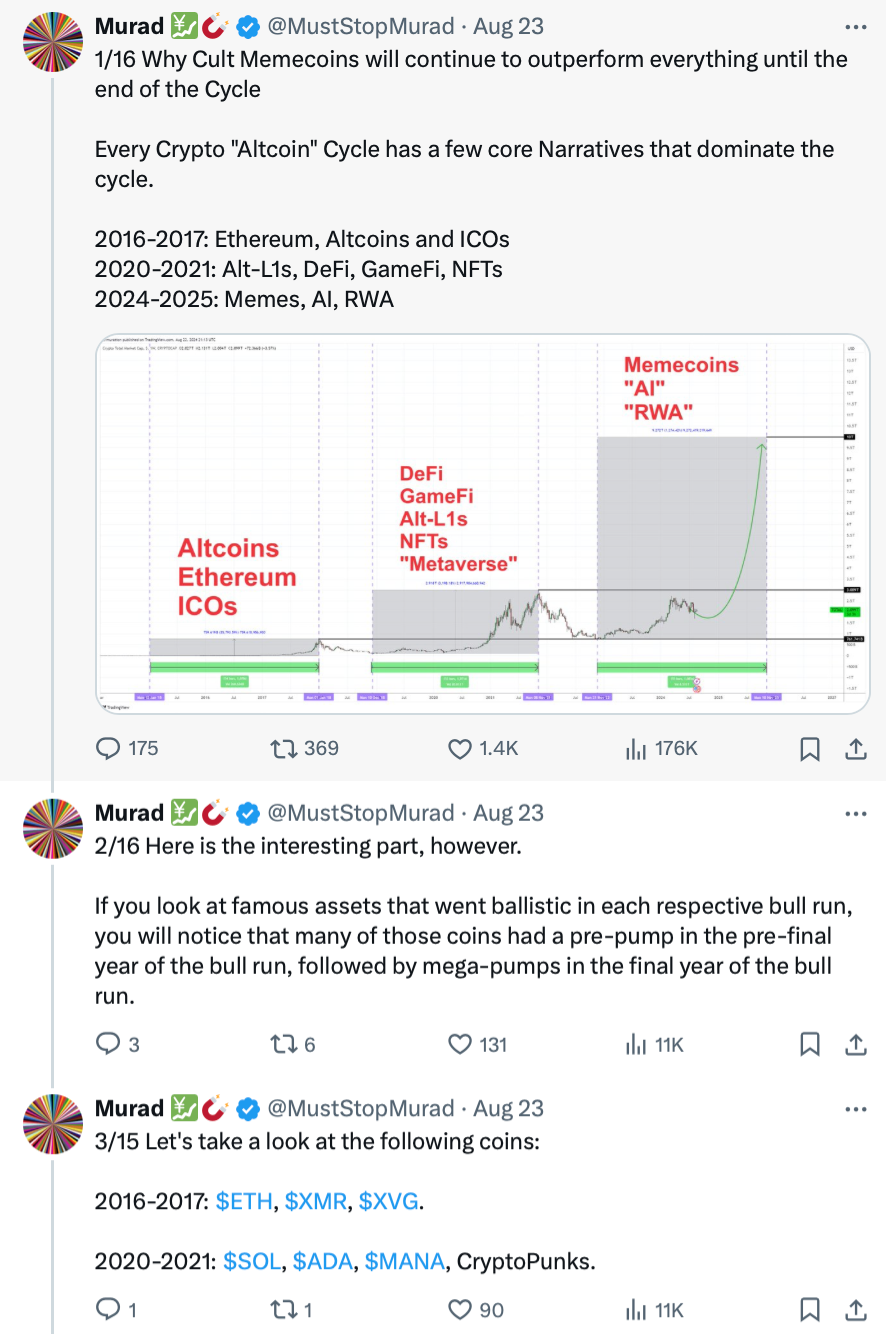

The crypto market has shown distinct narrative cycles throughout its history, as evidenced by clear patterns:

2016-2017: Dominated by Ethereum, Altcoins, and ICOs 2020-2021: Focused on Alt-L1s, DeFi, GameFi, NFTs 2024-2025: Emerging focus on Memes, AI, and RWA (Real World Assets)

The key difference in the current cycle is the separation between "technical" projects and social-driven assets, with memecoins leading performance across all categories.

Current Market Structure Evidence

Recent performance data reveals a striking disparity across crypto sectors:

New Memecoins Leading Returns:

- POPCAT: +14,802%

- WIF: +1,156%

- SPX6900: +7,883%

- GIGA: +61,060%

- MOG: +4,275%

Traditional Sectors Lagging:

- Most Layer 1s showing negative returns

- DeFi tokens underperforming

- AI tokens mixed performance

- ETH: +5%

- SOL: +55%

This stark performance difference suggests a fundamental shift in market dynamics rather than just speculative interest.

The Distribution Advantage

Current market data shows superior decentralization metrics for leading memecoins:

Top Performer Metrics:

- MICHI: 176 Median Holder Rank, 23 HHI

- SPX6900 (ETH): 162 Median Holder Rank, 30 HHI

- APU: 152 Median Holder Rank, 36 HHI

- GIGA: 127 Median Holder Rank, 28 HHI

These metrics indicate healthier distribution patterns than traditional altcoins, suggesting more sustainable price appreciation potential.

Market Size Dynamics

The current market structure presents a compelling case for potential exponential growth:

- Total Altcoin Market: ~$1,005B

- Traditional Altcoin Unlocks (2025-2029): ~$155B

- Current New Memecoin Market: ~$20B

- New Memecoins: Only 1%-5% of altcoin market

This disparity between market sizes suggests significant room for growth if even a small portion of capital rotates from traditional altcoins to memecoins.

Why This Time Could Be Different

1. Chain-Specific Advantages

Solana has emerged as the dominant chain for memecoin trading due to:

- Low transaction costs enabling small positions

- High retail accessibility

- Quick transaction finality

- Active trading community

- Sophisticated trading infrastructure

Ethereum provides:

- Institutional accessibility

- Highest liquidity

- Established infrastructure

- Professional market making

2. Community & Cultural Factors

Current successful memecoins show distinct characteristics:

- Fair launch mechanics

- No team allocations

- Strong community engagement

- Organic growth patterns

- Clear narrative strength

3. Development of Trading Infrastructure

Modern memecoin markets feature:

- BONK bot processing $200M daily volume

- Professional market making

- Advanced DEX infrastructure

- Cross-chain capabilities

- Institutional grade tools

Case Study: The WIF Pattern

The rise of WIF demonstrates the potential for explosive growth in the current market:

Initial Phase:

- Launch at ~$100K market cap

- Team sold early (~100K market cap)

- Strong community building

- Organic growth in holders

Growth Phase:

- Reached $3B market cap

- Global recognition

- Major exchange listings

- Strong holder metrics maintained

This pattern suggests the potential for similar trajectories in other well-structured memecoin projects.

Early Signs of the Supercycle

Several indicators suggest we're in the early stages of a potential supercycle:

- Cycle Timing:

- Currently in "Innovators" phase (2.5%)

- Early Adopters (13.5%) yet to enter

- Majority of potential participants still sidelined

- Performance Metrics:

- Memecoin sector outperforming all others

- Strong holder metrics in leading projects

- Growing institutional interest

- Infrastructure Development:

- Sophisticated trading tools emerging

- Professional market making

- Cross-chain capabilities expanding

The Path Forward

For a true supercycle to materialize, several factors need to align:

Critical Success Factors:

- Distribution Quality

- Fair launch mechanics

- Wide holder distribution

- Active trading volume

- Low concentration risk

- Community Strength

- Organic growth patterns

- Active content creation

- Strong social presence

- Regular engagement

- Technical Infrastructure

- Professional market making

- Exchange support

- Trading tools

- Cross-chain capabilities

Is the Memecoin Supercycle Coming? Part 2

Catalysts, Risks & Strategic Positioning

Understanding Market Psychology

Looking at current market data, we're witnessing an intriguing shift in how retail traders approach crypto investments. As Joe McCann noted in our discussions, there's a fundamental truth about market participants: "retail never cared about technology - what do they care about? Let's be real, they care about making money, having fun, and belonging somewhere."

Supply-Side Dynamics

The current market faces an unprecedented supply-side dynamic:

Traditional Altcoins:

- $155B in token unlocks (2025-2029)

- High VC ownership concentrations

- Complex vesting schedules

- Regular selling pressure

Successful Memecoins:

- 100% circulating supply

- No team allocations

- No future unlocks

- Clean supply dynamics

This stark contrast in supply mechanics could drive significant capital rotation as traders seek assets with cleaner price discovery mechanisms.

The Three-Phase Memecoin Pattern

Based on Murad's analysis, successful memecoins typically follow a three-phase pattern:

1. Community Formation Phase

- Must survive 2-3 major (70%+) drops

- Minimum 6 months existence

- Strong holder metrics development

- Organic community growth

2. Market Adoption Phase

- Exchange listings

- Increased liquidity

- Professional trading interest

- Broader market awareness

3. Mass Awareness Phase

- Viral social media presence

- Mainstream coverage

- FOMO-driven buying

- Peak trading volumes

Identifying Future Winners

Current market data suggests focusing on several key metrics:

Distribution Quality:

- Median Holder Rank > 100

- HHI score < 50

- No single wallet > 5%

- Growing holder count

Chain Selection:

Solana advantages:

- Low fees enable retail participation

- Quick settlement

- Active trading community

- Strong infrastructure

Ethereum benefits:

- Institutional accessibility

- Deepest liquidity

- Professional market making

- Established infrastructure

Risk Factors to Monitor

1. Distribution Red Flags:

- Team holdings > 20%

- Single wallets > 10%

- HHI scores > 100

- Concentrated early blocks

2. Community Warning Signs:

- Bot-driven engagement

- Paid marketing dominance

- Low organic content

- Weak holder metrics

3. Market Structure Risks:

- Low liquidity depth

- High concentration

- Irregular volume patterns

- Poor exchange support

Strategic Entry Framework

Based on successful patterns observed in WIF, BONK, and other leading memecoins:

Timing Considerations:

- Minimum 6 months market presence

- Multiple major drawdowns survived

- Clear community growth metrics

- Active daily trading volume

Position Sizing:

- No single position > 5% for new memecoins

- Core holdings maximum 10%

- Maintain 20-30% cash for opportunities

- Scale in over time

The Role of Infrastructure

The current market infrastructure is significantly more sophisticated than previous cycles:

Trading Infrastructure:

- BONK bot: $200M daily volume

- Professional market making

- Advanced DEX tools

- Cross-chain capabilities

Community Tools:

- Sophisticated social platforms like PUMP100X

- Enhanced wallet interfaces

- Better tracking tools

- Improved analytics

Catalysts to Watch

Several potential triggers could accelerate the supercycle:

1. Market Catalysts:

- Bitcoin halving effects

- ETF capital flows

- Institutional adoption

- Exchange listings

2. Social Catalysts:

- Viral community growth

- Influencer adoption

- Mainstream coverage

- Cross-platform expansion

3. Technical Catalysts:

- New trading infrastructure

- Enhanced liquidity tools

- Cross-chain bridges

- Improved user interfaces

Positioning for the Potential Supercycle

Based on current market evidence, a balanced approach might include:

Portfolio Structure:

- 40-50% Core Holdings (established memecoins)

- 30-40% Growth Positions (mid-cap cult memecoins)

- 10-20% Speculative Allocation (new, high-potential projects)

Chain Allocation:

- 70% Solana-based

- 20% Ethereum-based

- 10% Other chains

Conclusion: The Path Forward

The potential for a memecoin supercycle is supported by:

- Clean supply dynamics

- Superior distribution metrics

- Strong community engagement

- Advanced market infrastructure

- Growing institutional interest

However, success will likely be highly concentrated among projects that demonstrate:

- Strong holder metrics

- Fair initial distribution

- Sustainable growth patterns

- Clear narrative strength

- Robust liquidity

Current positioning in the innovation adoption curve (2.5% "Innovators" phase) suggests we're early in what could be a multi-year trend. The combination of market structure, technological infrastructure, and social dynamics creates unprecedented potential for sustained growth in the memecoin sector.

About the Author: Kobayashi Mememoto is an independent journalist with years of experience at the intersection of memes, crypto, and finance. Kobayashi's articles have been featured in several finance and crypto publications, with his main expertise being in memecoin trading. Mememoto's motto? "If you're not willing to lose it all on the next pump.fun jeet token, are you even investing?"