"Major investment banks now rate stocks based on 'memeability'. Traditional metrics declared obsolete."

In a seismic shift that has value investors rolling in their graves and Reddit's r/wallstreetbets users suddenly feeling like Warren Buffett, major investment banks have overhauled their stock rating systems to focus solely on a company's "memeability."

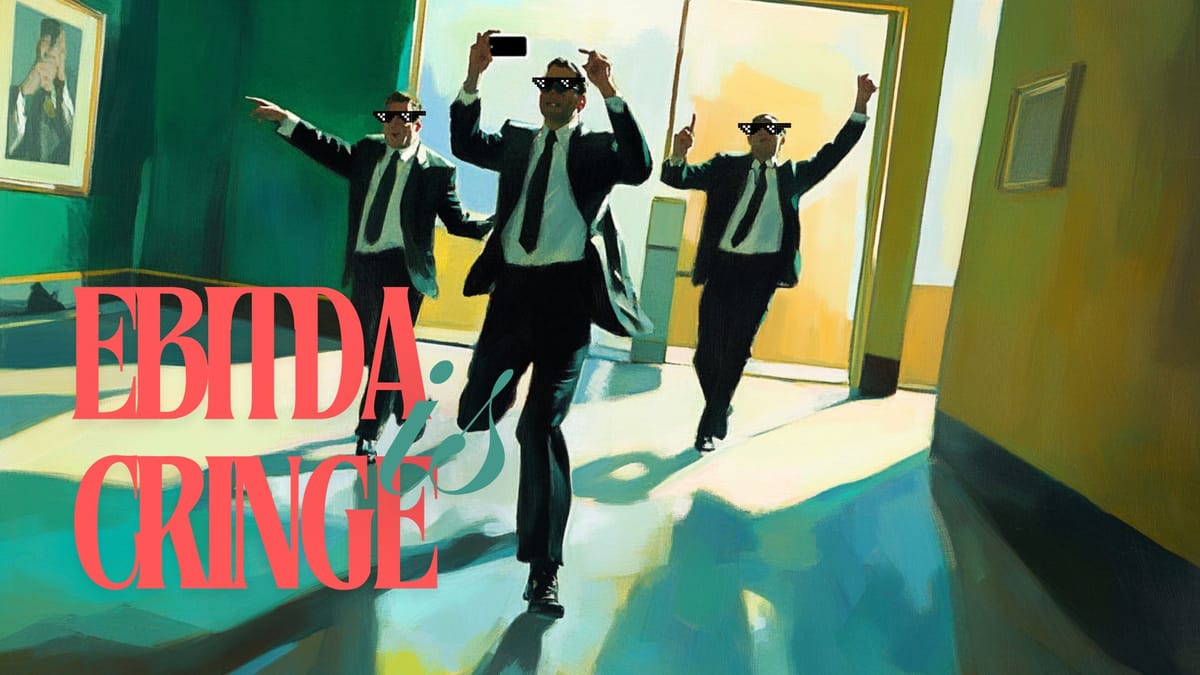

Gone are the days of price-to-earnings ratios, EBITDA, and cash flow analysis. JP Morgan Chase kicked off the trend by introducing its proprietary "Dank Stonk Index" (DSI), which rates stocks on a scale from "Cringe" to "God-Tier Tendies."

"We've finally embraced what the market has been telling us all along," said Jamie Dimon, CEO of JP Morgan, sporting a new "HODL or GTFO" face tattoo. "Fundamentals are for boomers. The real question is: can this stock make a killer TikTok?"

Goldman Sachs quickly followed suit with its "Viral Valuation Vector" (VVV), which assesses a company's worth based on its potential to generate spicy memes and rocket emoji spam on Twitter. Factors in the VVV include the CEO's shitposting ability, the stock ticker's pun potential, and how easily the company's logo can be turned into a reaction GIF.

Not to be outdone, Morgan Stanley unveiled its "YOLO Yield Metric" (YYM), which rates stocks based on their likelihood to make Redditors mortgage their parents' house for a FOMO-fueled buying spree.

The shift has sent shockwaves through the financial world. Fortune 500 companies are scrambling to rebrand themselves as meme-worthy. Berkshire Hathaway has changed its ticker from BRK.A to $BRRK, while ExxonMobil is now trading under $THICC.

"We used to spend millions on R&D," lamented one Fortune 500 CEO, who wished to remain anonymous. "Now our entire strategy revolves around whether we can get Elon Musk to tweet about us."

Business schools are struggling to keep up with the paradigm shift. Harvard Business School has hastily introduced a new course: "Advanced Memetic Warfare: How to Make Your Stock Go Brrrrr." Meanwhile, the CFA Institute is reportedly considering replacing its entire curriculum with a single question: "How many followers do you have on Stocktwits?"

As traditional analysts find themselves increasingly obsolete, a new breed of "meme quants" has emerged. These young guns, raised on a steady diet of Reddit and Monster Energy, are now commanding seven-figure salaries for their ability to predict the next stock to "moon" based on vibe alone.

When reached for comment, the SEC merely responded with a "This is fine" meme before quietly ushering in the heat death of efficient market hypothesis.

As the Memecoin Street Journal's chief vibeonomist always says, "When the normies can't tell if it's satire or financial advice, that's when you know it's time to go all in." Remember, in this brave new world of finance, the only technical analysis that matters is how many laser eyes you can fit on a chart. Wagmi, fam.