Meme Coin Market Analysis: Why Experts Predict a $1 Trillion Market Cap

Introduction: Beyond the Numbers

The prediction of a $1 trillion meme coin market cap isn't merely about numerical growth—it represents a fundamental shift in how value is created and maintained in the digital age. This analysis explores the interconnected factors that make this ambitious target more than just speculation.

The Perfect Storm: Convergence of Multiple Catalysts

1. The Great Unlock Problem

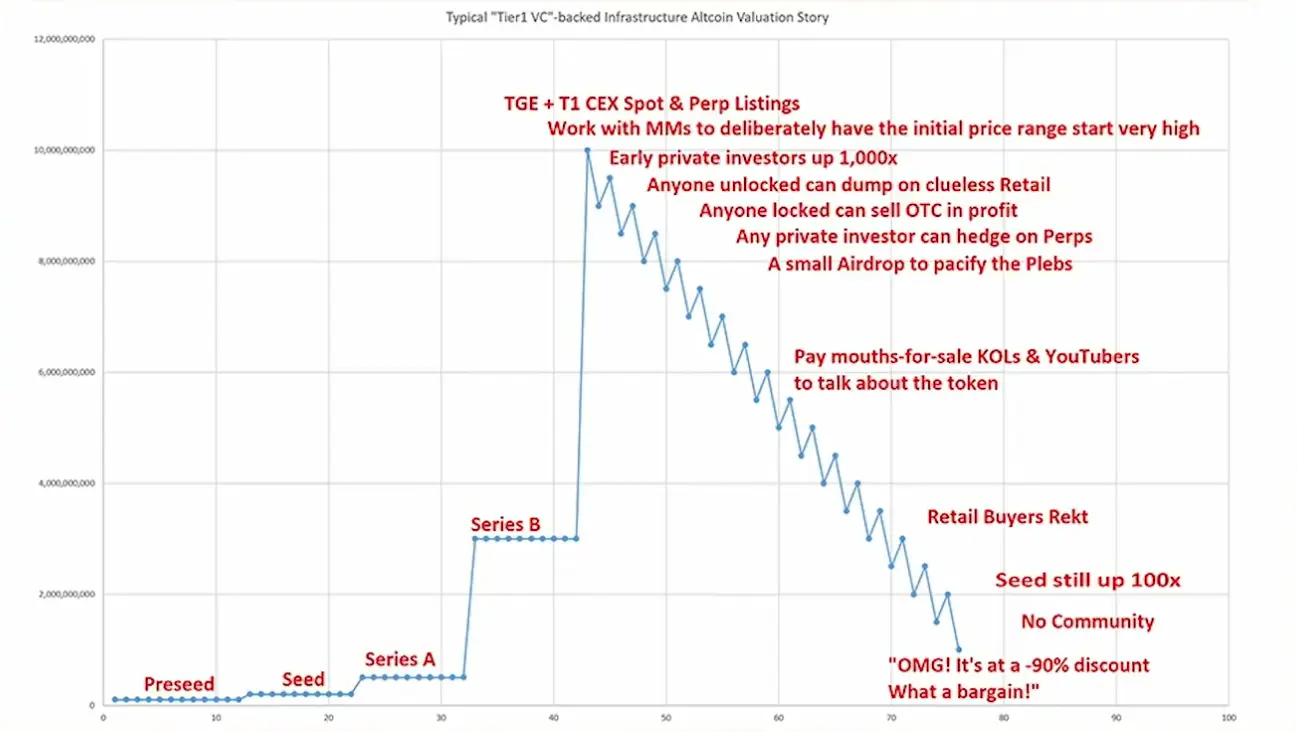

A critical but often overlooked catalyst for meme coin growth lies in the traditional crypto market's structural weakness. With "$155 billion worth of unlocks coming in the next 5 years" in traditional crypto, we're witnessing what could be called the "Great Capital Migration."

This massive supply overhang in traditional crypto creates a unique opportunity for meme coins, which typically have:

- No future dilution

- Fully circulating supply

- Clear price discovery mechanics

- Community-held majority stakes

2. The Simplification Revolution

The crypto market has reached a complexity breaking point. As Mike Dudas notes, "People become increasingly confused about why the coins that are being introduced these days need to exist." This complexity fatigue is driving a market-wide shift toward simpler narratives, creating what we might call the "Relatability Premium."

Key market shifts:

- Movement from technical to narrative-driven value

- Preference for easily understood concepts

- Rise of community-driven price discovery

- Decline of technical feature competition

3. The Social Transformation Catalyst

Modern society is experiencing what Murad identifies as multiple crises:

- Rising wealth inequality

- Increasing loneliness

- Declining traditional community structures

- Search for belonging and meaning

This social context creates perfect conditions for what we might call "Financial Communities 2.0"—where meme coins serve not just as speculative assets but as membership tokens in digital tribes.

The Evolution of Value Creation

The Three Waves of Meme Coins

- Wave One: The Joke Era (2013-2020)

- Dominated by Dogecoin

- Simple community structures

- Basic marketing

- Limited market impact

- Wave Two: The Multiplication Era (2021-2023)

- Multiple successful projects

- Animal themes dominance

- Initial community sophistication

- First signs of serious infrastructure

- Wave Three: The Movement Era (2024-Present)

- Ideology-based projects

- Mission-driven communities

- Professional structures

- Advanced market mechanics

This evolution shows a clear pattern: each wave brings higher sophistication and larger market capitalizations, suggesting the $1 trillion target aligns with this progression.

Market Mechanics and Psychological Drivers

The Network Effect Paradox

The Counter-Intuitive Supply Dynamic

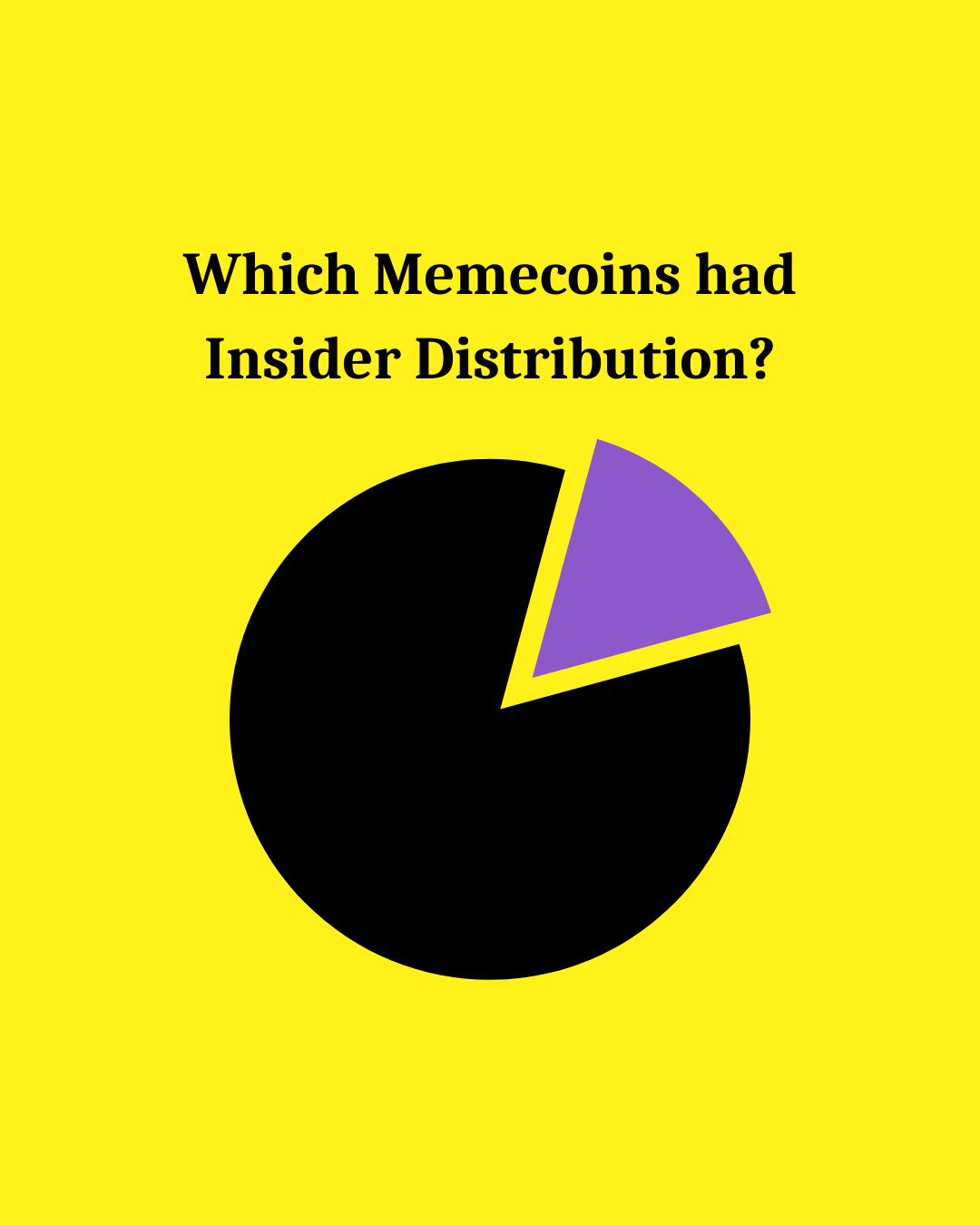

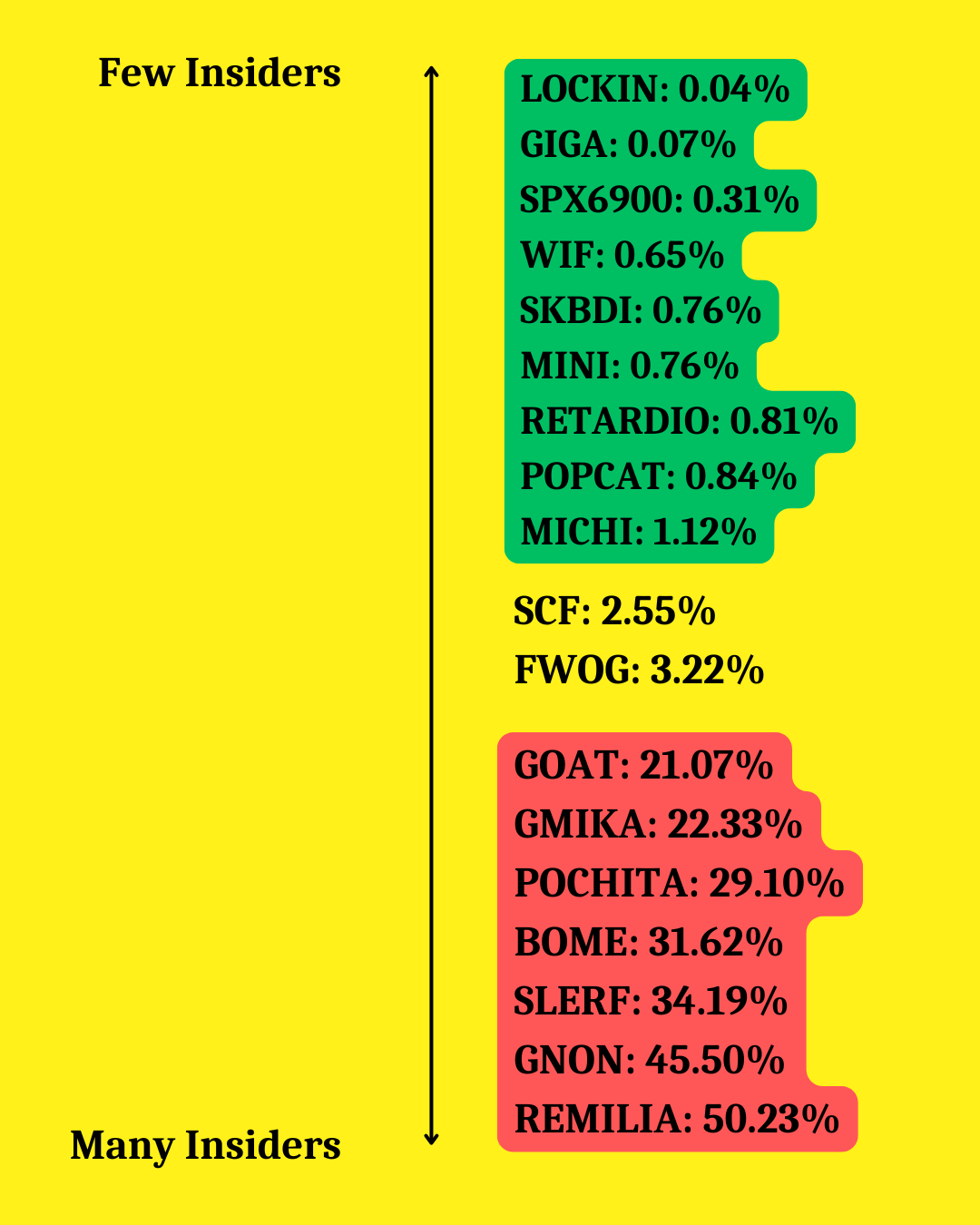

While traditional markets often suffer from oversupply, the meme coin space presents an interesting paradox. Despite Murad noting "10,000 coins being created per day" and potentially reaching "500,000 coins per day" in the future, this hyperinflation of choices actually strengthens successful projects through what we might call the "Attention Consolidation Effect."

How this works:

- Massive supply creates choice paralysis

- Investors seek recognized "safe havens"

- Capital concentrates in established communities

- Strong projects benefit from market noise

The Cult Formation Cycle

This leads to what we can identify as the "Cult Formation Cycle":

Strong Community → Holding Conviction → Price Stability → More Believers → Stronger Community

The Three-Tier Market Structure

1. Movement Coins (Top Tier)

Examples like SPX 6900 targeting $100 billion valuations represent what we might call "Ideology Markets." These projects transform traditional meme coins into what Murad describes as "tokenizing ideology or tokenizing philosophy."

Key characteristics:

- Mission-driven narratives

- Strong philosophical foundations

- Multi-cycle potential

- Professional management

2. Cultural Coins (Middle Tier)

Projects focusing on specific cultural niches or communities, characterized by:

- Strong community bonds

- Specific cultural alignment

- Medium-term holding patterns

- Regular engagement mechanics

3. Trading Coins (Base Tier)

The largest category by number but smallest by sustainable market cap, representing what Andre warns about: "This year millions of meme coins have been launched but how many successful ones have been launched? Just a few."

The Institutional Adoption Paradox

Traditional Finance Integration

A fascinating development is what we might call the "Institutional FOMO Cycle":

- Initial dismissal of meme coins

- Recognition of community power

- Attempt to understand social dynamics

- Gradual market participation

As Mike Dudas notes, this creates a situation where "VCs will be buying Blue Chip meme coins, Smart Ones are already beginning to do so."

The Technology Catalyst Effect

Platform Evolution

The emergence of sophisticated trading platforms has created what we can call the "Accessibility Multiplier Effect." This combines:

- Zero Friction Entry

- Instant token creation like on pump.fun

- Simple user interfaces

- Direct fiat on-ramps

- Mobile-first design like on PUMP100x.com

- Social Integration

- Real-time community interaction

- Live trading features

- Integrated communication

- Viral mechanics

The Gaming Convergence

As Anom predicts: "I think there's going to be a lot of ways that you set up similar mini games to pump fun with coins NFTs." This suggests a future where:

- Trading becomes gamified

- Communities become playing fields

- Rewards become more structured

- Engagement becomes measurable

The Market Cap Mathematics

Path to $1 Trillion

The trillion-dollar prediction isn't just aspirational—it's mathematically structured:

- Top Layer ($500B)

- 2-3 movement coins > $100B each

- 5-7 cultural coins > $20B each

- Top 10 established projects

- Middle Layer ($300B)

- 20-30 successful community projects

- Established brand recognition

- Strong holder bases

- Dynamic Layer ($200B)

- Trading volume from PVP activities

- New project launches

- Market speculation

Strategic Implications and Future Horizons

The Macro Convergence

Global Economic Catalysts

The path to $1 trillion is supported by what we might call the "Perfect Economic Storm":

- Monetary Environment Murad highlights that "the global money supply is growing exponentially," creating:

- Increased liquidity seeking returns

- Devaluation of traditional savings

- Search for alternative investments

- Need for community-based assets

- Social-Economic Pressures

- Rising wealth inequality

- Limited traditional investment opportunities

- Growing digital native population

- Seeking financial community belonging

The Bitcoin Correlation Factor

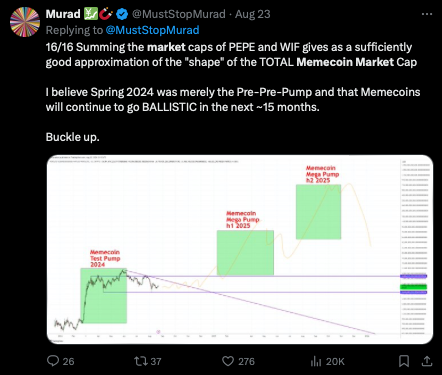

With Bitcoin predicted to reach "anywhere between 120k and 200k" (Murad), we can identify a "Meme Multiplier Effect":

- BTC rise validates crypto as an asset class

- Increased mainstream attention

- Spillover effects to meme markets

- Enhanced institutional interest

The Evolution of Value Capture

Next-Generation Features

- Hybrid Asset Models Anom predicts evolution toward:

- NFT-token combinations

- Fractionalized ownership structures

- Enhanced social features

- Gaming integrations

- Community-Driven Innovation What we might call "Social-Financial Fusion":

- Governance mechanisms

- Community rewards systems

- Social engagement metrics

- Value distribution protocols

Risk Factors and Mitigation Strategies

Primary Challenges

- Market Saturation Risk Andre's warning about millions of failed projects suggests need for:

- Enhanced due diligence frameworks

- Community strength metrics

- Leadership evaluation tools

- Sustainability indicators

- The Legitimacy Challenge Transition from pure speculation to sustainable value through:

- Mission-driven narratives

- Real community utility

- Cross-chain integration

- Institutional acceptance

Strategic Considerations

- Community Development Success factors include:

- Organic growth mechanics

- Long-term vision alignment

- Active participation incentives

- Clear value propositions

- Market Position Optimization Key strategies:

- Cross-platform presence

- Strategic partnerships

- Professional market making

- Brand development

The Path Forward

Critical Success Metrics

- Community Health Indicators

- Active participant ratio

- Message velocity

- Content creation rate

- Holder distribution patterns

- Market Structure Development

- Liquidity depth

- Exchange relationships

- Market maker presence

- Price stability mechanics

Future Market Structure

- Tier 1: Movement Coins Expected characteristics:

- $50B-100B market caps

- Global community presence

- Cross-cultural appeal

- Professional management

- Tier 2: Community Coins Projected features:

- $5B-50B market caps

- Strong niche communities

- Clear value propositions

- Sustained engagement

- Tier 3: Trading Coins Market role:

- Price discovery function

- Liquidity provision

- New user onboarding

- Innovation testing

Conclusion: Beyond the Trillion

The $1 trillion market cap prediction represents more than just numerical growth—it signals the maturation of a new asset class that combines financial value with social capital.

This evolution suggests a future where:

- Financial communities become normalized

- Social capital becomes quantifiable

- Community value becomes tradeable

- Digital tribes become investable

The path to $1 trillion isn't just about price appreciation—it's about the fundamental transformation of how humans create, maintain, and exchange value in the digital age. While challenges remain, the convergence of social, technological, and economic factors creates a compelling case for this ambitious target.

Remember that while the potential is significant, proper due diligence and risk management remain essential. The meme coin market's evolution will likely bring both opportunities and challenges that require careful navigation and strategic thinking.

About the Author: Kobayashi Mememoto is an independent journalist with years of experience at the intersection of memes, crypto, and finance. Kobayashi's articles have been featured in several finance and crypto publications, with his main expertise being in memecoin trading. Mememoto's motto? "If you're not willing to lose it all on the next pump.fun jeet token, are you even investing?"