Why Memecoins Could Outperform Traditional Crypto in 2025: A Deep Dive Analysis

The cryptocurrency market stands at a fascinating inflection point as we approach 2025. While traditional cryptocurrencies like Bitcoin and Ethereum continue to mature and gain institutional adoption, a new narrative is emerging that suggests memecoins could become the dominant force in the next major crypto bull cycle. This analysis explores the confluence of factors that could drive memecoin outperformance in 2025, backed by market data, social trends, and historical patterns.

The Evolution of Crypto Market Cycles

To understand why memecoins might dominate the next cycle, we must first examine the evolution of crypto market narratives. The 2016-2017 bull run was characterized by the ICO boom, where projects like Ethereum revolutionized fundraising and sparked a retail trading frenzy. Moving to 2020-2021, we saw the emergence of DeFi, NFTs, and GameFi as dominant narratives, with projects like Solana and Avalanche leading the charge.

Now, as we analyze the current 2024-2025 cycle, we're witnessing a fundamental shift in how value is created and captured in the crypto ecosystem. The market has evolved beyond traditional metrics like total value locked (TVL) or transaction volumes, moving toward a new paradigm where community engagement and viral potential drive value. This shift perfectly aligns with the core strength of memecoins.

The Supply-Side Revolution

One of the most compelling arguments for memecoin outperformance lies in the supply dynamics of the broader crypto market. Traditional altcoins are facing an unprecedented supply overhang, with approximately $155 billion worth of tokens scheduled to unlock between 2025 and 2029. This massive supply pressure could significantly dampen returns for conventional crypto assets.

In contrast, successful memecoins typically launch with 100% of their supply in circulation and no vesting schedules or token unlocks. This creates a much cleaner supply dynamic where price discovery is purely driven by market forces rather than predetermined selling pressure from early investors or team members. The importance of this cannot be overstated – when demand increases, there isn't a wall of supply waiting to be unleashed.

The Generational Wealth Shift

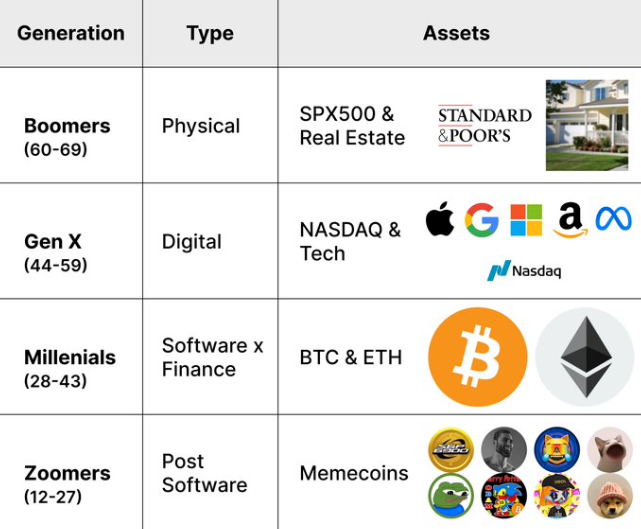

Perhaps the most fascinating aspect of the memecoin phenomenon is its perfect alignment with generational investment preferences. Current market data shows a clear progression in asset preferences across age groups:

Boomers (60-69) gravitate toward physical assets like real estate and traditional equities. Gen X (44-59) has embraced digital assets through tech stocks and the NASDAQ. Millennials (28-43) pioneered the adoption of Bitcoin and Ethereum. Now, we're witnessing Zoomers (12-27) emerge as the driving force behind memecoin adoption.

This generational progression isn't just a curious observation – it represents a fundamental shift in how younger investors approach wealth creation. Having witnessed traditional financial systems fail their parents and facing increasingly limited opportunities in conventional markets, Zoomers are naturally drawn to assets that combine investment potential with cultural relevance and community participation.

The Technology Paradox

One of the most counterintuitive aspects of memecoin potential is what we might call the "technology paradox." Traditional crypto projects often compete on technical specifications – faster transactions, more sophisticated smart contracts, or novel consensus mechanisms. However, market data increasingly suggests that technical superiority has little correlation with market performance.

Current year-to-date performance metrics tell a striking story: while sophisticated DeFi protocols and Layer 1 solutions struggle with negative returns (many down 60-80%), simple memecoins have delivered returns ranging from 1,000% to 14,000%. This isn't a temporary anomaly but rather a reflection of a fundamental market truth: in digital assets, community engagement and narrative strength often trump technical sophistication.

The Distribution Advantage

Looking at current market data, successful memecoins demonstrate superior distribution metrics compared to traditional crypto assets. Take for example top-performing memecoins like WIF or POPCAT, which show healthy Herfindahl-Hirschman Index (HHI) scores and high median holder ranks. These metrics indicate genuine community ownership rather than concentrated institutional holdings.

This distribution advantage creates a powerful flywheel effect. When ownership is widely distributed among active community members rather than concentrated among VCs and institutions, each holder becomes a potential marketing force for the project. This organic growth mechanism is far more powerful and sustainable than traditional marketing approaches used by conventional crypto projects.

The Liquidity Revolution

The emergence of sophisticated market-making and trading infrastructure specifically designed for memecoins has created unprecedented liquidity conditions. Projects like the BONK bot, processing over $200 million in daily volume, demonstrate how memecoin trading has evolved from simple speculation to a sophisticated market with proper depth and price discovery mechanisms.

The Psychology of Mass Adoption

The path to mainstream crypto adoption may not unfold as many technology maximalists have envisioned. While traditional crypto projects focus on complex technical solutions and institutional adoption, memecoins have discovered a powerful truth about human nature: people are far more likely to engage with assets they can emotionally connect with and understand intuitively.

Consider the stark contrast in user experience between traditional DeFi and memecoin participation. To engage with DeFi, users must understand concepts like impermanent loss, yield farming, and liquidity provisioning. In contrast, memecoin participation requires only an understanding of basic human emotions: humor, community, and the shared experience of being part of something larger than oneself. This simplicity becomes a feature, not a bug, when considering mass adoption potential.

The Financial Nihilism Factor

A deeper sociological force driving memecoin adoption is what market analysts have termed "financial nihilism." In an era of rising inequality, stagnant wages, and diminishing opportunities for traditional wealth creation, younger generations are increasingly drawn to high-risk, high-reward investment opportunities. This isn't merely about gambling or speculation – it represents a rational response to an economic system that many young people view as fundamentally broken.

Memecoins perfectly capture this zeitgeist. Their very nature – often launching with seemingly absurd premises and achieving astronomical valuations – serves as both a critique of traditional finance and a potential pathway to wealth creation for those locked out of conventional opportunities. The irony that a dog-themed token could create more wealth for its holders than years of traditional saving and investing isn't lost on this generation – it's precisely the point.

The Network Effect Multiplier

Traditional crypto projects often struggle with the chicken-and-egg problem of adoption: users won't join without utility, but utility can't be demonstrated without users. Memecoins sidestep this problem entirely by making community participation itself the utility. This creates a powerful network effect that becomes self-reinforcing as the community grows.

Current market data supports this theory. Looking at social engagement metrics, successful memecoins often show exponential growth in community participation even during price downturns. This resilience in community engagement suggests that memecoin holders are motivated by factors beyond mere price speculation, creating a more sustainable growth model than traditional crypto assets.

The Institutional Paradox

Perhaps counterintuitively, increasing institutional adoption of Bitcoin and major cryptocurrencies could actually drive retail investors toward memecoins. As traditional cryptocurrencies become more correlated with mainstream financial markets through ETFs and institutional products, retail investors seeking non-correlated returns and asymmetric opportunities may increasingly turn to the memecoin sector.

This dynamic is already visible in current market data. While Bitcoin's correlation with traditional risk assets has increased following the launch of spot ETFs, memecoin price action continues to show relatively low correlation with both traditional markets and major cryptocurrencies. This decorrelation benefit could become increasingly valuable in portfolios as traditional crypto assets mature.

The Innovation Cycle Advantage

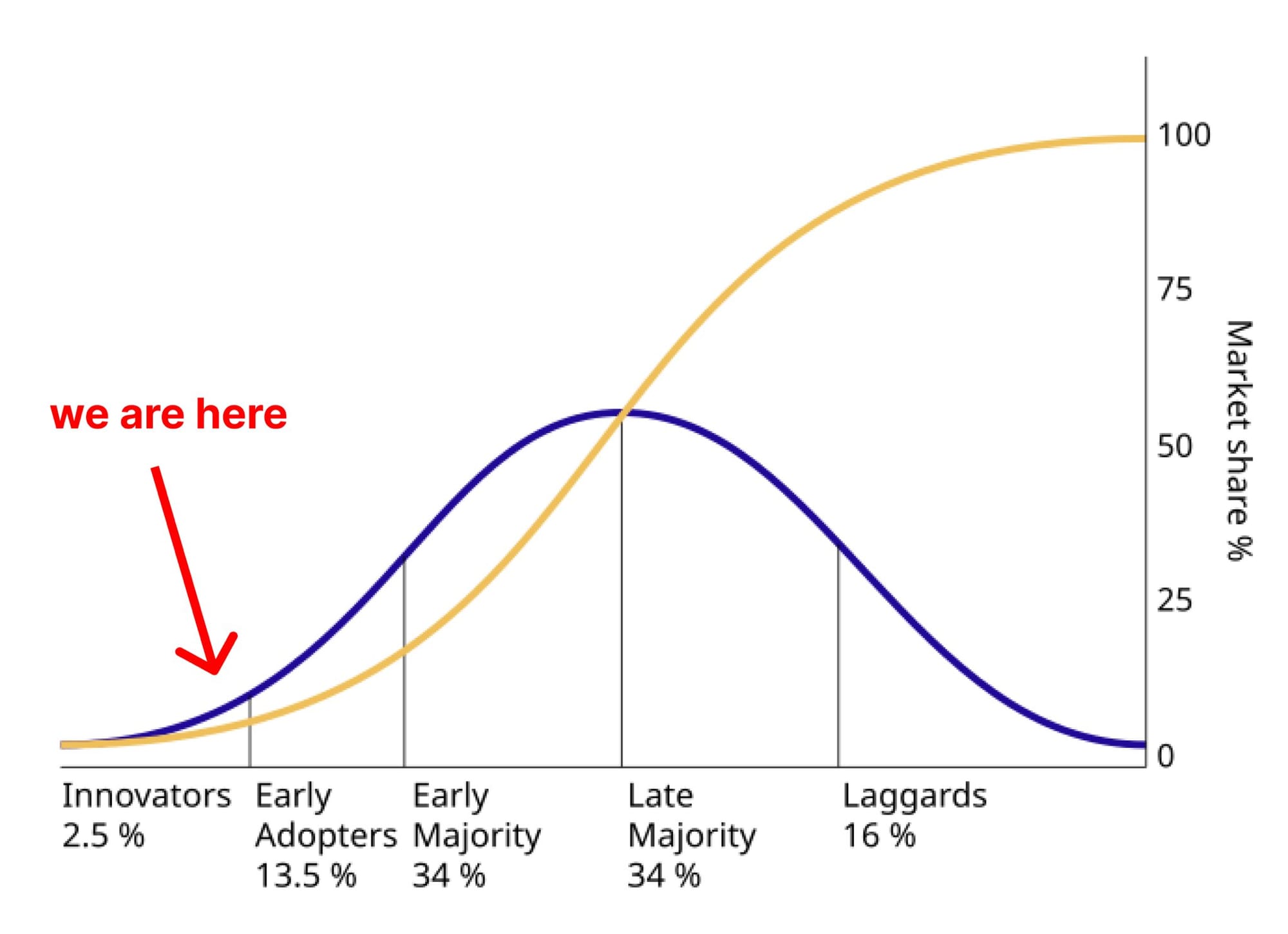

Looking at the classic innovation adoption curve, current data suggests we're still in the "Innovators" phase (2.5%) for memecoin adoption. This positioning is crucial for understanding the potential upside in 2025. As we move into the "Early Adopters" phase (13.5%), the market could experience exponential growth as more mainstream investors begin to participate.

Historical crypto cycles show that assets leading in performance during the early phase of a cycle tend to maintain their leadership position through the cycle's peak. Current year-to-date performance data shows memecoins dramatically outperforming all other crypto sectors, suggesting this leadership could extend through 2025.

The Social Media Amplification Effect

The rise of short-form video content and algorithmic content distribution has created perfect conditions for memecoin growth. Platforms like TikTok and Instagram Reels can turn memecoin communities into viral phenomena overnight, reaching audiences far beyond traditional crypto circles. This distribution advantage is particularly powerful because it reaches younger audiences who are predisposed to digital asset ownership.

Traditional crypto projects, with their focus on technical specifications and financial metrics, often struggle to create content that resonates on these platforms. Memecoins, by their very nature, are perfectly suited for viral social media content, creating a substantial marketing advantage that compounds over time.

The Market Size Opportunity

Current market data provides perhaps the most compelling argument for memecoin outperformance in 2025. With the total altcoin market capitalization around $1,005 billion and new memecoins representing only about $11 billion, the potential for growth is enormous. Even a modest reallocation of capital from traditional altcoins to memecoins could result in multiplicative returns for well-positioned memecoin projects.

This opportunity is magnified by the fact that many traditional altcoins face significant sell pressure from token unlocks ($155 billion through 2029), while successful memecoins typically have no such supply overhangs. This clean supply dynamic could make memecoins increasingly attractive to traders and investors seeking assets with clearer price discovery mechanisms.

Conclusion: The Perfect Storm

As we look toward 2025, multiple factors are aligning to create potentially perfect conditions for memecoin outperformance. The combination of generational wealth shifts, social media dynamics, supply-side advantages, and psychological factors creates a compelling case for continued memecoin sector growth.

However, it's crucial to note that not all memecoins will succeed. Success will likely concentrate in projects that demonstrate strong community metrics, fair distribution patterns, and sustainable growth mechanisms. The key to capitalizing on this trend will be identifying projects with strong fundamentals while maintaining strict risk management practices.

The memecoin phenomenon represents more than just a speculative bubble – it's a fundamental shift in how younger generations approach investment and community building in the digital age. As we move through 2024 and into 2025, this shift could drive returns that challenge conventional wisdom about value creation in crypto markets.

About the Author: Kobayashi Mememoto is an independent journalist with years of experience at the intersection of memes, crypto, and finance. Kobayashi's articles have been featured in several finance and crypto publications, with his main expertise being in memecoin trading. Mememoto's motto? "If you're not willing to lose it all on the next pump.fun jeet token, are you even investing?"